BT Group looks to Fibre First strategy, with £3.7 billion annual investment as 13,000 job cuts announced, said GlobalData. BT Group's overall restructuring path of cost cutting is a means to drive sustainable long term growth and reverse the downward trend in earnings

This move follows BT’s announcement last year of a reduction of 4,000 roles in similar areas, of which 2,800 have been removed to date - resulting in a cost saving of £180m over the year.

In the recent earnings release from BT Group, the big announcement came in the form of 13,000 job cuts over the next three years, primarily within back office and middle management roles, coming at a cost of £800m.

Stephanie Char, Associate Analyst Global Telecom at GlobalData, a leading data and analytics company, commented “The blow is somewhat softened with Openreach stating plans to hire 3,500 new trainee engineers over the coming 12 months to support its Fibre First programme”.

BT Group’s revenue for the 2017/18 financial year was down 1% year-on-year with adjusted EBITDA for the same period falling 2%; CEO Gavin Patterson expects that the Group will only see EBITDA return to growth from 2021 onwards.

BT Group and Openreach have shown increasing commitment towards this Fibre First strategy, with an annual CAPEX allocation of around £3.7 billion towards improving their FTTP network and mobile infrastructure. This is expected to drive the operator to hit its target of 3 million premises passed by FTTP by end-2020, and 10 million by the mid-2020s.

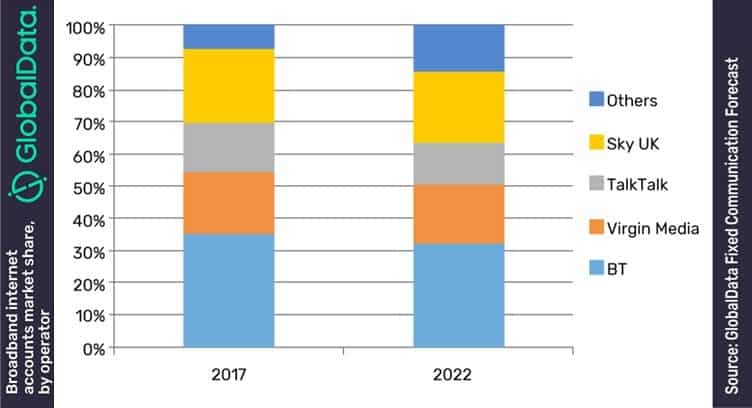

Char continued, ‘‘GlobalData expects BT to continue to lead the broadband market, though its market share of broadband internet accounts is expected to continue to fall from 35.3% in 2017 down to 32% in 2022. Declines in market share are expected for all major operators as newer market entrants like Plusnet and John Lewis, and mobile operators Vodafone and Three make inroads in the broadband market.’’

On the TV side, BT’s customer base declined just slightly, by 10k users over the past 12 months. However, performance from BT Sport remained strong with viewing figures across all platforms up 19% year-on-year over the last 3 months. This was very much down to BT Sport’s strong portfolio of live sports and exclusive broadcasts, including rights to continue showing Premier League matches for a further three years from the 2019/20 season, in a deal worth £295m per season.